YOUR LIFE PLAN

Take The Guesswork

Out Of Your Future

Fellows does a good job choosing and managing our clients’ investments. But it’s only part of all we do. We have the deeper, “what if” conversations: What happens to your family? The business? Your personal wealth? The business assets? Your legacy? Then, together you and your advisor find the right answers for increasing your prosperity and your peace of mind.

LIFE

INVESTMENTS & INCOME STREAMS

TAX REDUCTION

ESTATE & LEGACY PLANNING

BUSINESS SUCCESSION & EXIT STRATEGY

EXECUTIVE BENEFITS

INSURANCE PROTECTION

STEP 1

Creating Your Life Plan

Once we’ve had that deeper conversation with you, we begin to plan: how to optimize income, focus investments on specific goals and minimize taxes. We look at how tools like business succession planning, estate planning, and insurance figure in. Then we widen the focus to see the whole picture — from potential risks and opportunities to strategies and safeguards. So instead of pouring everything into investments, taking tax hits and sacrificing a good life today for the hope of eventually retiring, you have a plan that’s focused on moving toward specific goals and enjoying life along the way.

WEALTHCARE PROCESSWEALTHCARE PROCESS

Uniquely Accurate Projections Reflect Your Personal Priorities

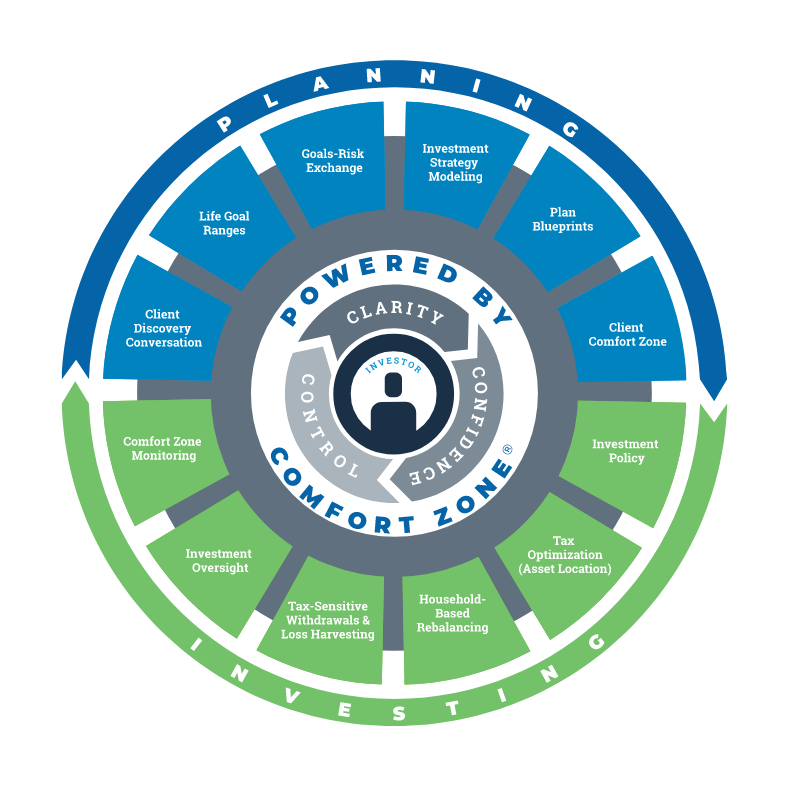

As a Wealthcare firm, Fellows Financial Group uses Wealthcare’s patented process for creating a custom plan that integrates comprehensive planning with targeted investing.

We base your life plan on your actual investments, milestones, goals and the personal legacy you want to leave. It’s more than financial planning, retirement planning, tax planning or estate planning: it’s all of that and it’s all those components talking to each other to amplify your wealth and protect it.

NEXT STEP

FELLOWS FINANCIAL

GROUP ADVISOR

OTHER TRUSTED PARTNERS

BUSINESS BROKER BENEFITS

LOAN OFFICER

ATTORNEY

INSURANCE SPECIALIST

MARKET TRADER

CPA ACCOUNTANT

STEP 2

Putting Your Plan Into Action

We surround you with professionals who are experts with specific aspects of your life plan. If you already have a trusted CPA and attorney, we’ll make them part of our team and work together to build and execute your plan. If you don’t have a great CPA and attorney, we do —along with experts in insurance, estate planning and business operations.

Once we assemble your team members, we don’t step away. We’re there in meetings with you, working proactively for you—gathering information, building strategy and collaborating side by side with you and your team to put the right plan into action and drive momentum.

From strategy and execution, to paperwork, tracking, investment management and other action items, your Fellows advisor does the ground work to make it simple to follow your plan from now … to the future.

NEXT STEP

STEP 3

Updating Your Plan As Life Changes

Whenever there’s a shift in your business or personal life —or the economic climate—your advisor will work with you to adapt your Life Plan. We can scale up protections, realign investments, redefine your business exit strategy or strengthen estate planning to protect against new risks or seize new opportunities. Plus, we’ll know when you’ve saved enough to spend on milestones along the way: education, weddings, travel, a vacation home and the ultimate goals of enjoying a secure retirement and leaving a legacy that matters.

YOUR MAP TO THE FUTURE